Real Estate Loan Types

Bridge Loans

Short-term financing for quick property acquisition or renovation projects.

Fix & Flip Loans

Funding for investors purchasing and renovating properties for resale.

Construction Loans

Financing for ground-up construction projects, including residential and commercial properties.

DSCR Loans

Debt Service Coverage Ratio loans tailored for rental properties, focusing on the property’s income potential.

Portfolio/Blanket Loan

Our platform supports cross-collateralizing many properties into one loan with detailed information on each property including: valuation, Rent rolls, cash flow, allocated loan amount, LTV, DSCR, ARV, LTC, LTP, etc…

CRE Lending

Commercial Real Estate loans for purchasing or refinancing office buildings, retail spaces, multi-family units, and industrial properties.

Residential or Commercial Land Loans

Financing options for purchasing undeveloped land, whether for residential or commercial development, including lot loans and raw land loans.

Consumer Mortgages

Conventional Loans (Fannie Mae/Freddie Mac), FHA, VA, Jumbo & Non-QM.

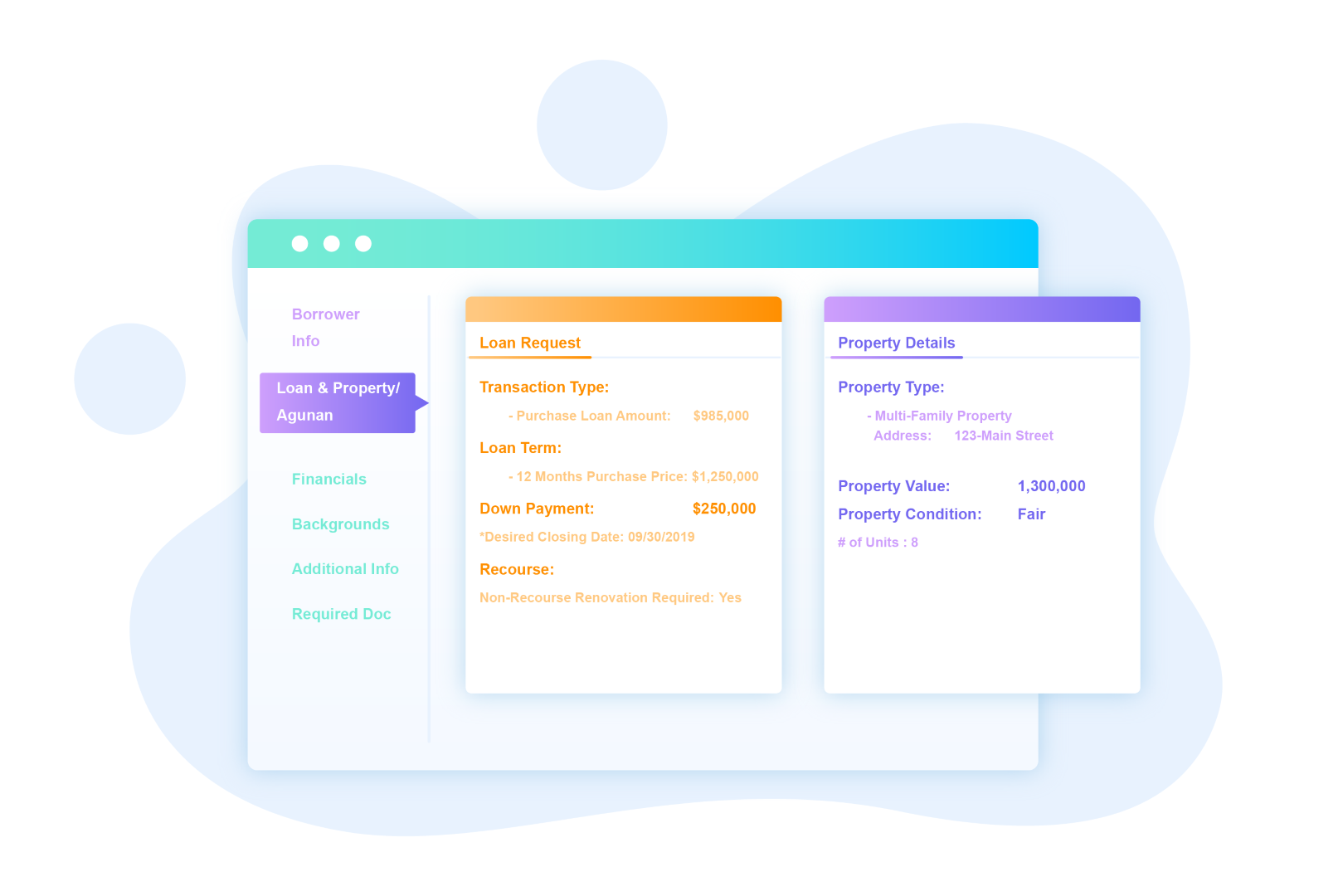

Customizable Loan Origination Software

Go to market faster with our turnkey & highly customizable loan origination software platform used by commercial & private lenders & brokers for Resi, CRE, Agency, SBA, Business funding & alternative lending products.

SBA 7(a) Loans

Flexible loans that can be used for purchasing or refinancing owner-occupied commercial real estate, including office buildings, retail spaces, and industrial properties. Loan terms can extend up to 25 years with competitive interest rates.

SBA 504 Loans

Designed specifically for purchasing fixed assets like commercial real estate and large equipment. These loans offer long-term, fixed-rate financing with terms up to 25 years, typically structured with a 50-40-10 split between a lender, a Certified Development Company (CDC), and a borrower.

Core Features

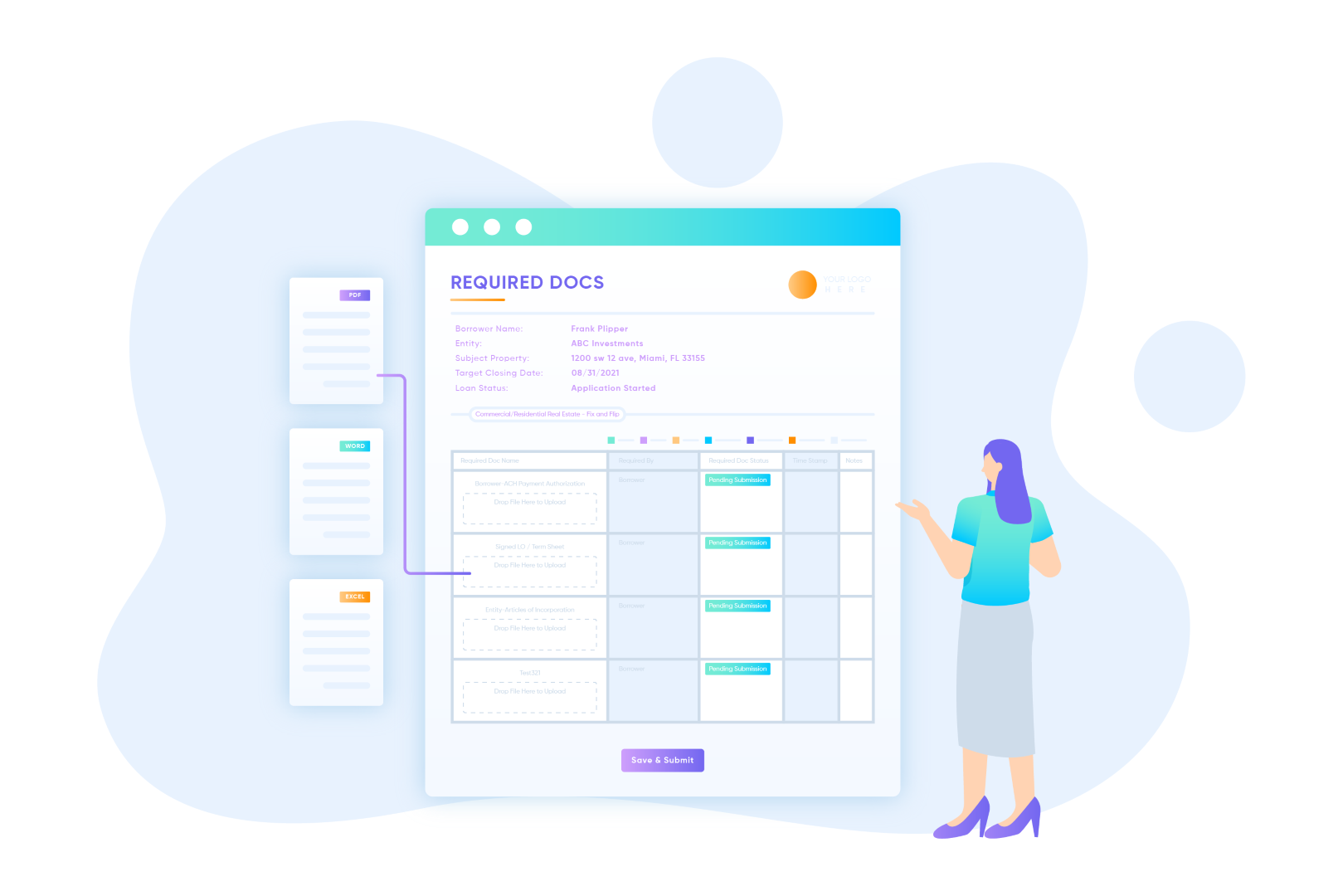

Loan Application Intake with Required Document Upload

A streamlined application process with customizable forms that ensure all necessary documents (e.g., property appraisals, title documents, income verification) are uploaded at the point of application.

Workflow Automation

Automated processes that trigger next steps based on loan status, including document requests, appraisal orders, compliance requirements, and borrower communications.

Document Generation

Automatically generate commonly used documents such as term sheets, loan estimates, closing disclosures, mortgage notes, and SBA-specific forms at various stages of the loan origination process.

Pipeline Management

Visual tracking of each loan from application to closing, with real-time status updates and task assignments to team members.

E-Signature Integration

Simplify the signing process with built-in e-signature capabilities for quick and secure document execution.

Customizable Loan Programs & Calculations

Tailor loan terms and conditions to match specific real estate financing needs, including adjustable rates, balloon payments, and interest-only periods. Supported calculations & ratios: LTV, DTI, DSCR, LTC, ARV, Etc…

Customizable Guidelines

Build out your own or back end investor/lender eligibility guidelines, so the system knows what fields, required docs & workflow steps to follow on every loan.

White-Labeled User Architecture

Empower your broker channel with a fully white-labeled portal that reflects their brand identity. This feature supports multiple branches or offices, allowing brokers to manage their own teams, loans, and communications under their own branding.