Customizable Loan Origination Software

Go to market faster with our turnkey & highly customizable loan origination software platform used by commercial & private lenders & brokers for Resi, CRE, Agency, SBA, Business funding & alternative lending products.

We thought of everything to make your LOS dream come true!

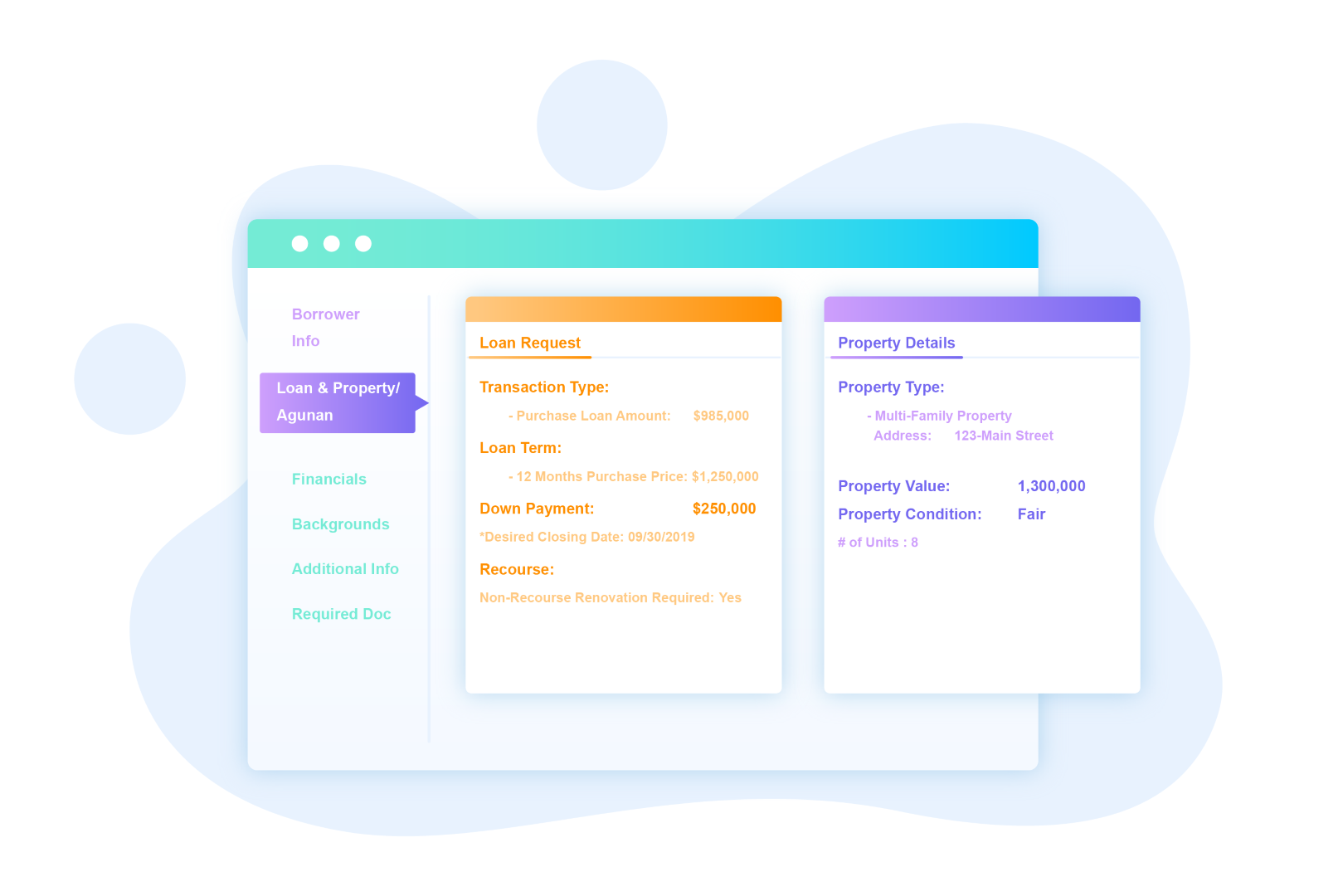

Smart Online Loan Applications (POS) that are customizable & dynamic to each loan program

LendingWise provides you with pre-built, customizable web forms for a quick app & full app. They allow brokers & borrowers to select loan programs, which activate the respective fields and required docs based on the loan program & other loan parameters. Here is an example Quick App & Full App

Pre-configured for: Bridge, Fix & Flip, Construction, Rental, Portfolio, Agency/Conventional, SBA, MCA, Equipment & Customize your own loan programs

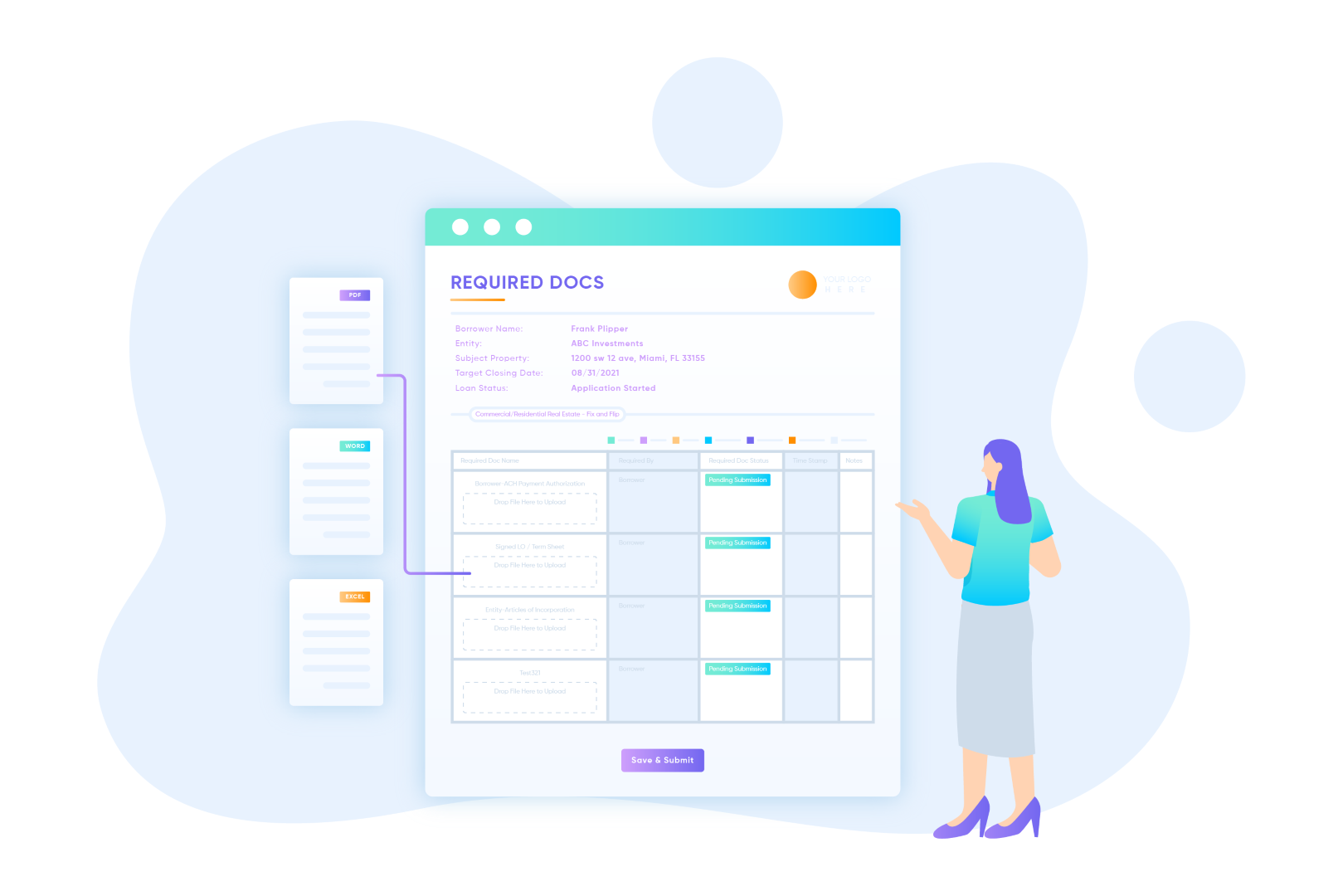

Smart Doc Collection by Owly™

Collecting required docs is a pain point for every lending transaction. Our loan origination software will always ask for the right docs, at the right time based on the selected loan program and other parameters like transaction type, property type, property state, entity type, entity state, credit score range, and more. Let Owly, our loan processing software, run on auto-pilot to collect all the required docs or use our outsourced processing to follow up with borrowers & verify all the required docs are correct.

Auto-Generate E-Sign Ready Docs

LendingWise has a library of built in docs for loan applications from various lenders, term sheet, credit auth, disclosures & closing docs. You can also send us your preferred docs and we can auto-populate them with E-signable options as well. You can also create your own auto-generated docs/excel using our doc wizard tool that allows you to insert dynamic fields from our database powered by Google Docs & Sheets

Loan specific workflows & milestones

Create detailed workflow steps specific to a loan program and other parameters like transaction type, property type, property state, entity type, entity state, credit score range, and more. Automated events can create auto-assigned tasks or E-mails to any party associated to the loan.

Additional LOS Features

For 15+ years we have listened to our broker & lender user community to help build the most comprehensive, flexible CRM & LOS Loan Origination software for private lending, commercial real estate, business funding, SBA loans and more.

Custom Loan Programs, Guidelines & Investor Overlays

Create custom loan programs with your own unique guidelines

or for back end investors. This helps you build out loan files that meet your requirements along with investors covering custom fields, workflow steps, required docs & automations.

Unique Calculations & Ratios

We support numerous niches across the lending industry from fix & flip, construction, rental loans, CRE, to SBA business loan. Our LOS system will help calculate DTI, DSCR, LTV, LTC and ARV to name a few.

3rd Party Integrations

We offer numerous 3rd party integrations for processors and underwriters to access data for credit, background check, KYC, asset verification, AVM, appraisal, tax verification, entity verification, and more. Our open API allows for webhooks as well.

Tool Tip Helpers

Dummy proof your entire business process by customizing numerous tool tips to help borrowers, brokers and any user on your platform to understand or learn more about specific fields, required docs, workflow steps, loan programs or file status.